- #Pdf form filler online free how to

- #Pdf form filler online free code

- #Pdf form filler online free free

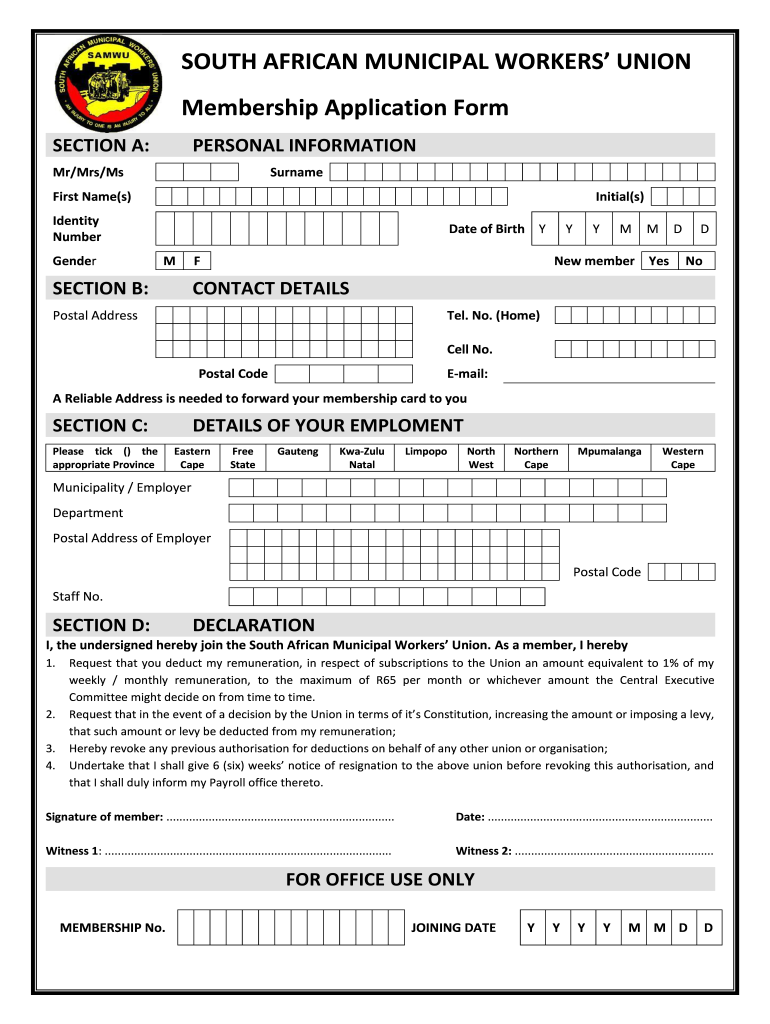

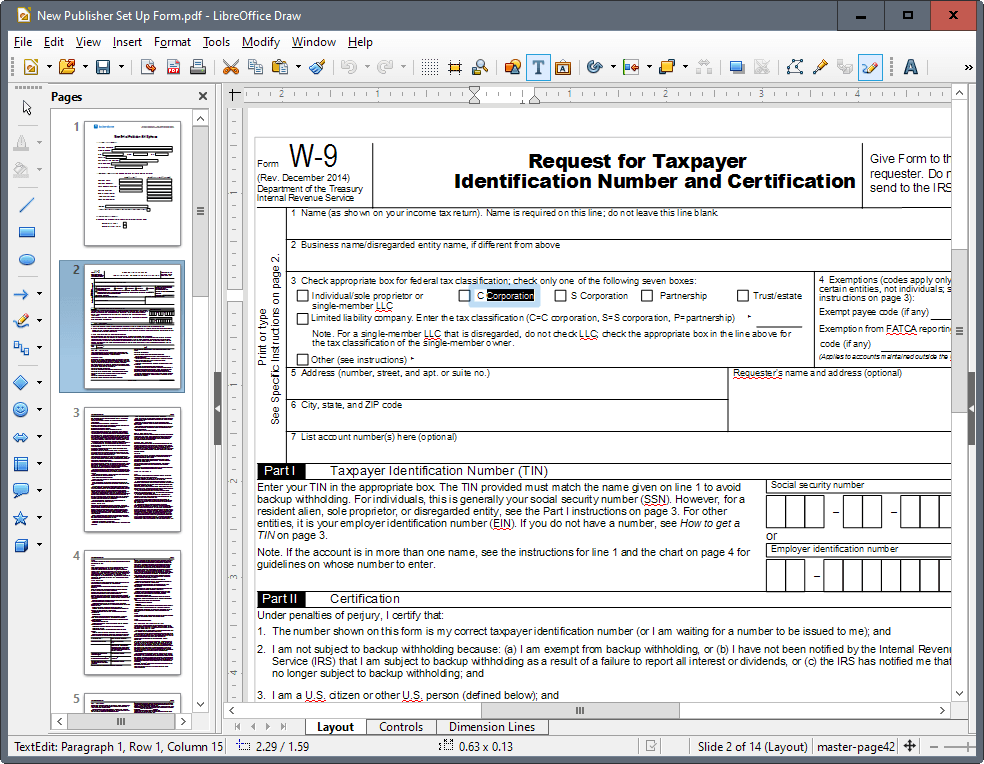

ICs and freelancers are responsible for withholding (and paying) their own taxes. This is because employers withhold the proper taxes on behalf of the employee. In fact, taxes for contractors are usually more complicated than the taxes of an employee. Self-employment does not erase the requirement of filing a tax return. It is a popular myth that contractors and freelancers don't have to pay taxes.

Remember, the form should not be sent to the IRS. If you provide false information, you could face serious legal ramifications. Your signature promises the government that everything listed on the form is true to your knowledge. Part II CertificationĬarefully read the certification before you sign it.

You can either use your SSN, an assigned tax number, or an employer identification number (EIN) if you have one. The final fields are the taxpayer identification number (TIN) field and the certification field. Part I Taxpayer Identification Number (TIN) It is a space to place the requester's name and address. To the right of those boxes, you'll find an unnumbered box.

#Pdf form filler online free code

In Box 6, fill in the city, state, and zip code for the address from Box 5.īox 7 is an optional field below for an account number(s) that helps the two parties identify the purpose of the W-9. This includes any apartment number, lot number, or suite number. government agency is exempt as a payee, as are corporations and dealers in securities. In Box 4, you'll list the proper code (found in the instructions) to use if you're exempt from backup withholding or subject to FATCA. This box won't apply to most individuals as long as they can identify their status through one of the other checkboxes. The instructions provided by the IRS should be consulted. Do not use this box if you are a single-member LLC.įinally, you'll see a checkbox for Others.

It is used if you have a special designation associated with your LLC, such as C Corp, S-Corp, or partnership tax status. You'll also notice that there's another checkbox for LLC. If you're part of a Partnership or Trust / Estate, choose the proper receptacle. If you're an S Corporation, check the appropriate box. If you're a C Corporation, check the second box. If you are an individual without a legally formed business, a sole proprietor, or a single-member LLC, place a checkmark in the first box. However, if your business name were Smith Content Creation Services, Inc., you'd place that name in Box 2. For example, if your name is Joe Smith, and you don't have a separate business entity, you would leave it blank. We're going to use that form to cover the fields of the requested information.Įnter your business name if it is different from what you entered in Box 1.

#Pdf form filler online free free

Although you can provide the required information to the requesting party without a W-9, there's no reason to forgo the IRS form since it is free and easy to find online. Let's get familiar with the fields (fillable parts) contained in IRS W-9 Form. For example, if you're self-employed and haven't incorporated your business, you wouldn't provide a business name. You may find that not all of the grounds apply to you and your situation. This tax document may be found online on the IRS website: When you're asked to fill in a W-9, you should complete the required fields. The IRS W-9 Form certifies that the TIN (taxpayer identification number) given is correct (or that the person is waiting for an amount to be issued), that the person is not subject to backup withholding, or that the person is exempt from backup withholding because they are an exempt payee. There's one more essential thing you should know. You've already learned a little about the information requested on a W-9.

#Pdf form filler online free how to

How To Fill Out A W-9 Form Overview of fields Remember that it is a tool to gather specific information that a business needs to complete a 1099-NEC if the contractor earns more than a certain amount during the tax year. It should not be sent to the Internal Revenue Service. The business should retain the information on this form for several years. However, if a contractor provides you with an updated address or a name change, those changes may be recorded for use. Verifying the information on this form and keeping it up-to-date ensures you collected accurate personal information.įorm W-9 should be reviewed and updated yearly. The W-9 Form is an essential tool for employers to gather information about contractors for income tax purposes. The form asks for information such as the IC's name, address, social security number (SSN), and more.

The W-9, or Request for Taxpayer Identification Number and Certification form, provides a business with relevant personal information about an independent contractor (IC) or freelancer for tax purposes in the United States.

0 kommentar(er)

0 kommentar(er)